E Way Bill API

Generate both parts and do everything else with your e-way bills with Atlas

Reduce manual efforts, eliminate chances of errors

Seamless integration with robust security and infrastructure

Plug and Play, no coding required

7Bn+ API calls processed

300K+ businesses served

Zero downtime since inception

7Bn+ API calls processed

300K+ businesses served

Zero downtime since inception

Trusted by

E way Bill API available Functions

Generate EWB

Extend validity of EWB

Get EWB/consolidated EWB

Get IRN details

Reject EWB

Update EWB

Generate EWB by transporter/consignor

Get EWB details by IRN

Consolidate EWB

Authenticate EWB

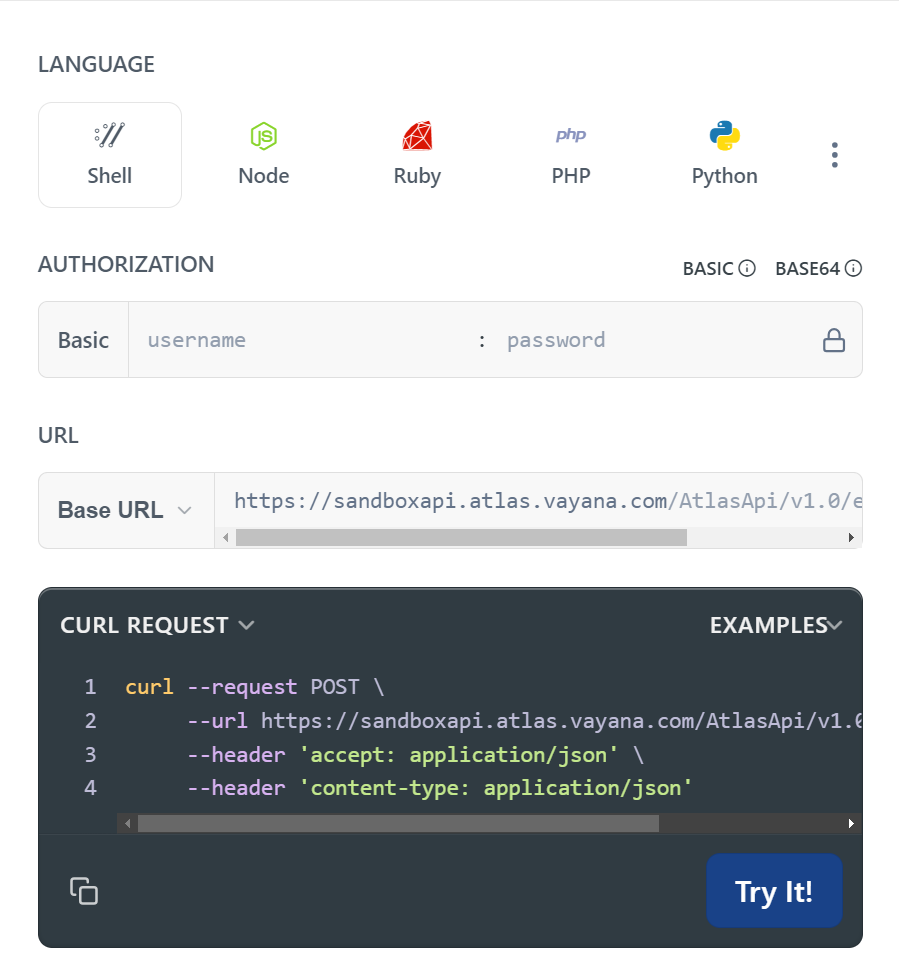

Designed for Developers

We encourage developers to integrate with Atlas. Our E-Way Bill API uses xyz architecture…

Other solutions you might be interested in

Trade Verification APIs

Combat invoice frauds and overcome manual invoice sampling challenges

GST Reconciliation APIs

Claim 100% ITC with advanced matching systems and stay compliant

E-Invoicing APIs

Create, cancel, update and do everything else with e-invoicing APIs

Frequently Asked Questions

An e-way bill is a mandatory document for the person in charge of a conveyance carrying goods exceeding a value of fifty thousand rupees, as required under Section 68 of the Goods and Services Tax Act and Rule 138 of the rules framed under it. This bill is generated from the GST Common Portal for the eWay bill system by registered persons or transporters who are responsible for the movement of goods before the movement commences.

The requirement for an e-way bill is mandated by Section 68 of the GST Act, which allows the government to specify that certain goods of a value exceeding a predetermined amount must be accompanied by specified documents and devices. Rule 138 of the CGST Rules, 2017, identifies the e-way bill as the necessary document for the conveyance of goods in specific cases, thus necessitating its generation from the common portal.

Yes, e-way bills have a validity period, which is determined by the distance to be covered by the goods in transit. For regular vehicles or modes of transportation, the validity is one day for every 100 kilometers or part thereof. In the case of Over Dimensional Cargo (ODC) vehicles, the validity is one day for every 20 kilometers or part thereof. This validity period expires at midnight on the last day.

The calculation of the e-way bill’s validity period considers the day to start from the time the bill is generated. For instance, if an e-way bill is generated at 00:04 hrs on March 14, the first day of validity ends at midnight between March 15 and 16. Similarly, if the bill is generated at 23:58 hrs on March 14, the first day still ends at midnight between March 15 and 16, with subsequent days following a similar pattern.

In the context of e-way bills, API integration is vital for enabling efficient communication between the e-way bill system and the systems used by taxpayers or transporters.

The e-way bill API serves as an interface for various actions such as generating, updating, canceling, or rejecting an e-way bill, which can be executed on the e-way bill developer portal. It facilitates communication between two distinct applications, essentially functioning as a messenger that not only delivers information but also conveys responses back to the user. This integration ensures seamless data exchange and operational efficiency in managing e-way bills.

The E-way bill, essential for transporting goods, comprises two parts. PART-A requires details like the delivery location, recipient’s GSTIN, goods value, invoice/challan/receipt numbers, HSN code, among others. In PART-B, transport-related information such as the vehicle number and transporter ID is mandatory. For bill generation, the transporter must have completed E-way bill registration.

When goods are dispatched, the supplier fills in PART-A and leaves PART-B for the transporter, who then completes it. If the transport vehicle changes during transit, the transporter must update this new conveyance information in the E-way bill on the portal.